The art of selecting the right algorithm depends entirely on the problem's nature. While linear regression predicts quantities like housing prices, logistic regression decides between binary outcomes - think loan approvals. SVMs, with their mathematical elegance, handle intricate datasets that baffle simpler models. The secret lies in matching the tool to the task's unique demands.

Unsupervised Learning Algorithms

When answers aren't provided, unsupervised algorithms become explorers, uncovering hidden structures in raw data. K-means and hierarchical clustering transform chaos into order, grouping similar data points like customers with matching buying habits. These techniques reveal what wasn't asked directly - ideal for discovering market segments or spotting fraudulent transactions.

Principal Component Analysis (PCA) performs data alchemy, distilling hundreds of features into their essential components. This dimensionality reduction preserves critical information while eliminating noise, making it indispensable for analyzing genetic data or streamlining image recognition systems.

Reinforcement Learning Algorithms

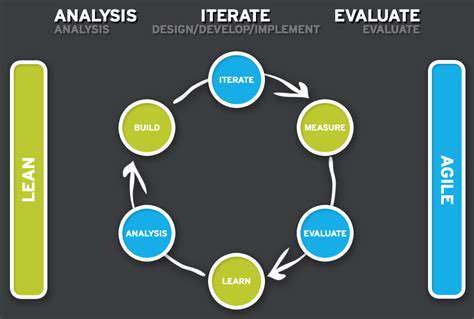

Reinforcement learning mimics human trial-and-error learning, where algorithms earn rewards for good decisions. This approach revolutionizes fields lacking pre-packaged training data, from teaching robots to walk to optimizing energy grids. The algorithm's journey from random actions to expert strategy mirrors how children learn through experience.

What makes these systems remarkable is their adaptability. As environments change - whether stock markets or video games - the algorithms continuously refine their strategies. This dynamic learning process enables applications ranging from self-driving cars to personalized recommendation systems that evolve with user preferences.

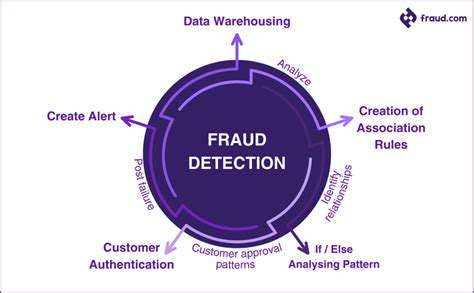

Beyond Transaction Data: Comprehensive Fraud Detection

Beyond Transactional Data: Unveiling the Deeper Insights

While transaction records tell what happened, they rarely explain why. Modern analytics digs deeper, connecting purchase patterns with social media activity, device usage, and even typing speed. This multidimensional view transforms fraud detection from guessing to knowing.

The most effective fraud systems now analyze hundreds of behavioral signals - how someone holds their phone, their typical login times, even how they navigate apps. These subtle behavioral fingerprints often reveal fraud attempts that bypass traditional checks.

Customer Behavior and Preferences

Today's customers leave digital footprints across websites, apps, and call centers. Analyzing this trail reveals not just what they buy, but how they make decisions. The most successful companies detect hesitation patterns - those moments when customers almost abandon carts or repeatedly compare options.

Segmenting customers by behavior (rather than demographics) uncovers surprising insights. Some luxury buyers comparison-shop extensively, while bargain hunters often impulse-buy. These behavioral truths reshape marketing from art to science.

Market Trends and Competitor Analysis

Competitive intelligence now leverages AI to analyze thousands of pricing changes, product launches, and promotional campaigns. Advanced systems can predict competitor moves by recognizing patterns in their historical behavior and executive statements.

The most sophisticated models incorporate geopolitical events, weather patterns, and even social media sentiment. When a viral tweet critiques a competitor's product, smart systems immediately assess the opportunity.

Operational Efficiency and Process Improvement

Modern analytics illuminates operational blind spots. Machine learning identifies which customer service scripts actually resolve issues fastest, or which warehouse layouts minimize walking time. The best insights often come from correlating seemingly unrelated metrics - like how office lighting levels affect software bug rates.

Process mining tools visually map how work actually flows (versus official procedures), revealing where bottlenecks consistently form. These process X-rays regularly uncover 20-30% efficiency gains.

Predictive Analytics and Future Forecasting

Cutting-edge forecasting now blends internal data with external signals - from satellite images of competitor parking lots to forum discussions about emerging technologies. The most accurate predictions weight hundreds of weak signals rather than relying on few strong ones.

Some retailers predict local demand spikes by analyzing school calendars and event schedules. When a city hosts a marathon, smart systems automatically increase inventory of sports drinks and pain relievers in nearby stores.