Introduction to E-commerce Fraud

Understanding E-commerce Fraud

E-commerce fraud encompasses a wide range of malicious activities aimed at exploiting online businesses and consumers. These schemes can involve unauthorized access to accounts, payment details theft, fake account creation, and manipulated product reviews. Recognizing these threats is essential for crafting robust prevention measures. Businesses must analyze transaction patterns, spot anomalies, and train staff to identify red flags signaling suspicious behavior.

Criminals frequently target sensitive financial information like credit card numbers and bank details, which can lead to identity theft or funding illegal operations. Fraudsters constantly refine their methods to bypass security systems, making it critical for companies to stay vigilant and update their defenses regularly.

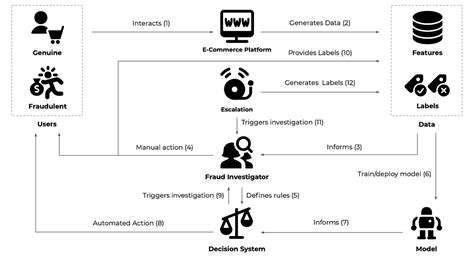

The Role of Machine Learning in Detection

Machine learning transforms fraud detection by processing enormous datasets to uncover subtle fraud patterns human analysts might overlook. These algorithms learn from historical fraud cases, enabling them to adapt to new scam tactics. Their dynamic nature makes them invaluable in combating ever-evolving online fraud schemes.

ML systems excel at detecting nuanced fraud indicators like abnormal purchase behaviors, mismatched shipping details, or inconsistent user activity. These sophisticated detection capabilities allow businesses to intercept fraud attempts earlier, minimizing financial damage while protecting legitimate customers.

Developing Effective Prevention Strategies

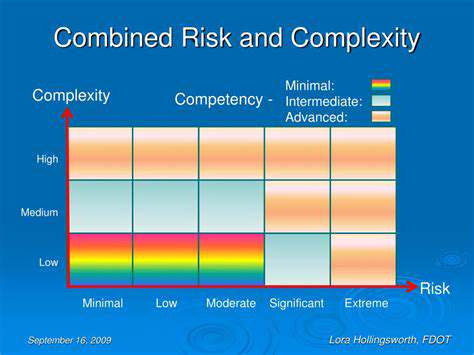

Building a successful ML-based fraud prevention system requires multiple components working in harmony. It begins with meticulous data preparation and selection of appropriate algorithms, followed by continuous model refinement. High-quality data is essential – poor data leads to unreliable predictions and security gaps.

A comprehensive security approach combines ML with traditional safeguards like strong authentication protocols and encrypted payment processing. This multi-layered defense strategy creates a formidable barrier against fraud attempts while maintaining smooth customer experiences.

Real-World Applications and Future Trends

ML models already demonstrate impressive results combating various e-commerce fraud types, from account hijacking to payment scams. Current implementations show substantial reductions in fraudulent transactions when integrated with existing platforms.

Future developments will likely incorporate advanced deep learning and natural language processing to detect increasingly sophisticated fraud patterns. Continuous model improvement will be paramount as fraud techniques grow more complex, ensuring ongoing protection for digital commerce ecosystems.

The Role of Machine Learning in Fraud Prevention

The Foundation of Machine Learning in Fraud Detection

Modern fraud detection systems leverage machine learning to uncover patterns invisible to human analysts. These algorithms process massive transaction volumes, identifying subtle fraud indicators hidden within complex data streams. By learning from historical fraud cases, the systems adapt to recognize emerging scam tactics in real-time.

ML's ability to analyze enormous datasets rapidly gives it a critical advantage over traditional methods. This speed enables financial institutions to respond to threats immediately, significantly reducing potential losses.

Classifying Fraudulent Activities

Machine learning systems effectively categorize diverse fraud types, from payment scams to identity theft. They analyze multiple data points including transaction details, user behavior patterns, and even external events to accurately flag suspicious activities.

Predicting Future Fraudulent Events

Beyond detecting existing fraud, ML models can forecast potential threats by analyzing behavioral trends. This predictive capability creates a proactive security layer far more effective than reactive approaches.

This forward-looking protection enables businesses to implement preventative measures, dramatically reducing fraud-related damages.

Real-time Fraud Detection

ML's most significant advantage lies in its real-time processing capability. Modern systems can evaluate transactions and user behavior in milliseconds, immediately flagging suspicious activity as it occurs.

Adapting to Evolving Fraud Tactics

As criminals develop new scam methods, ML systems continuously learn from fresh data to maintain detection effectiveness. This constant adaptation is essential for sustaining robust fraud prevention.

The Future of Machine Learning in Fraud Detection

The evolution of fraud prevention will parallel ML advancements. Integration with biometric verification and behavioral analysis will create even more precise detection systems, promising enhanced security for digital financial transactions.

Key Machine Learning Models for E-commerce Fraud Detection

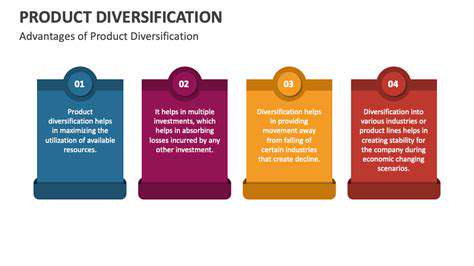

Supervised Learning Models

Supervised learning models are crucial for fraud detection and other e-commerce applications. These models learn from labeled historical data to predict outcomes for new cases. Common examples include logistic regression for classification and decision trees for pattern recognition. They're widely used for customer behavior analysis, product recommendations, and fraud identification.

Their pattern recognition capabilities help businesses make data-driven decisions. By understanding customer behaviors, companies can optimize marketing strategies and improve service personalization.

Unsupervised Learning Models

Unsupervised models analyze unlabeled data to discover hidden patterns and relationships. Clustering algorithms like k-means help identify customer segments and product affinities, enabling better merchandising strategies.

Dimensionality reduction techniques like PCA simplify complex datasets while preserving critical information. This aids in visualizing customer preferences and market trends more effectively.

Reinforcement Learning Models

These models excel in dynamic decision-making scenarios. In e-commerce, they can optimize pricing strategies and inventory management in real-time. The models learn through environmental interaction, receiving feedback that shapes future decisions.

For instance, they can dynamically adjust product pricing based on market demand and competitor activity to maximize profitability. This continuous learning approach enhances operational efficiency over time.

Data Preparation and Feature Engineering for Effective Models

Data Collection and Cleaning

High-quality data collection forms the foundation of effective fraud detection. Establishing clear protocols for data sourcing and validation ensures reliable analysis results. This phase often involves gathering information from multiple sources including transaction logs and user profiles.

Data cleaning removes inconsistencies and errors that could compromise model accuracy. Techniques include handling missing values and standardizing formats. Thorough data validation is crucial before progressing to analysis stages.

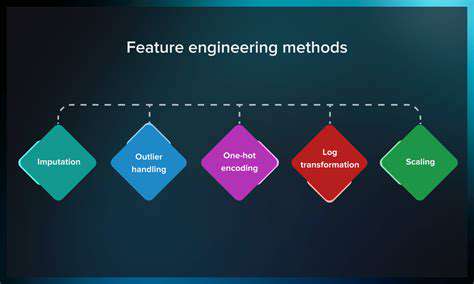

Feature Selection and Engineering

Identifying the most relevant data features significantly enhances model performance. Proper feature selection reduces computational load while improving detection accuracy. Methods include statistical analysis and algorithmic feature importance scoring.

Feature engineering creates new predictive variables from existing data. This process can reveal complex relationships that boost model effectiveness, such as creating interaction terms or derived metrics.

Data Transformation and Scaling

Converting data into analyzable formats is essential for model training. Techniques include normalizing numerical ranges and encoding categorical variables. Appropriate transformations dramatically improve algorithm performance across different data types.

Feature scaling ensures variables contribute equally to model outcomes. Standardization prevents variables with larger ranges from dominating the analysis, particularly important for distance-based algorithms.

Data Splitting and Validation

Proper dataset division into training, validation, and test sets prevents overfitting. This approach evaluates model performance on unseen data, ensuring real-world applicability. Cross-validation techniques provide more reliable performance estimates.

Robust validation strategies generate realistic performance assessments. They help avoid inflated accuracy claims and ensure models generalize well to new data.

Handling Imbalanced Datasets

Fraud detection often involves highly imbalanced data where fraud cases are rare. Techniques like oversampling minority classes or algorithmic adjustments help create balanced models. The chosen method depends on specific business needs and risk tolerance.

Careful handling of class imbalance is critical for accurate fraud prediction. Proper technique selection ensures models don't overlook important but rare fraud cases.

Deployment and Monitoring for Continuous Improvement

Deployment Strategies for Preventing Fraud

Effective fraud prevention requires tailored deployment strategies matching business scale and complexity. Phased implementation starting with pilot programs allows thorough testing and refinement. This approach minimizes operational disruption while validating system effectiveness.

Continuous performance monitoring during pilots enables real-time adjustments. Feedback loops help algorithms adapt to emerging fraud patterns and business requirements.

Monitoring for Continuous Improvement

Ongoing surveillance is vital against evolving fraud tactics. Real-time monitoring dashboards highlight anomalies and suspicious patterns, with customizable alerts for different risk levels.

Regular pattern analysis informs strategy refinements. Visualization tools help teams quickly interpret complex data and respond to emerging threats.

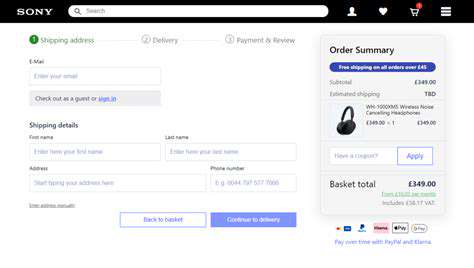

Integration with Existing Systems

Seamless integration with order processing systems enables real-time fraud screening. This embedded protection examines every transaction without disrupting customer workflows. Comprehensive testing ensures compatibility across all business systems.

Connecting with payment processors and CRM systems provides complete customer context. This holistic view enhances fraud detection accuracy by incorporating historical behavior patterns.

Reporting and Analysis for Enhanced Effectiveness

Detailed performance reports quantify prevention system effectiveness. They identify successful interceptions, financial impacts, and areas needing improvement. Data-driven insights guide resource allocation and strategy optimization.

Analytics uncover system weaknesses and training gaps. Targeted improvements based on these findings strengthen overall fraud prevention capabilities.