Mobile Wallet Security: A Crucial Concern

Mobile wallets, while convenient, present unique security challenges. Protecting sensitive financial information, such as credit card details and PINs, is paramount. Robust encryption and multi-factor authentication are essential components of a secure mobile wallet ecosystem. Users should be vigilant about phishing attempts and fraudulent applications, ensuring they only download from trusted sources.

Moreover, regular security audits and updates for the mobile wallet application are vital. This ensures that the latest security patches are implemented to counter emerging threats and vulnerabilities. Furthermore, users should enable two-factor authentication whenever possible, adding an extra layer of protection against unauthorized access. This combination of proactive measures is crucial for maintaining the integrity and safety of mobile wallet transactions.

The Seamless Integration of Payment Methods

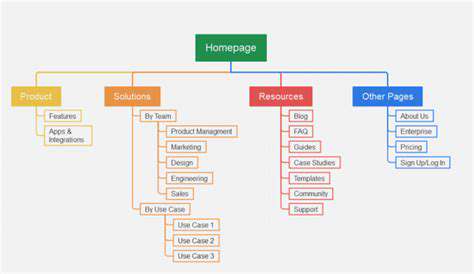

One of the key advantages of mobile wallets is their ability to consolidate various payment methods into a single platform. Users can easily manage multiple credit cards, debit cards, and even digital payment methods all within one app, simplifying the payment process. This streamlined experience is a significant improvement over the traditional method of carrying numerous physical cards.

This streamlined approach not only enhances convenience but also reduces the risk of losing or misplacing physical payment cards. This streamlined approach also allows for easier tracking of expenses and budget management, making it easier for users to keep tabs on their spending habits.

The Impact on Retail and Commerce

Mobile wallets are rapidly transforming the retail and commerce landscape. They are enabling faster checkout times and reduced wait times for customers, leading to improved customer experience in stores. This improvement in efficiency is particularly crucial for businesses in high-volume environments.

Furthermore, mobile wallets are driving the adoption of contactless payments, which offer a faster and more hygienic payment method compared to traditional methods. This adoption is likely to continue growing in the coming years.

The Role of Mobile Wallet Adoption in Financial Inclusion

Mobile wallets are playing a critical role in financial inclusion, especially in underserved communities. They offer a convenient and accessible way to send and receive money, often bypassing traditional banking infrastructure. This is particularly important in regions with limited access to physical bank branches.

This accessibility is empowering individuals to participate more fully in the financial system, fostering economic growth and development. Mobile wallets are bridging the gap for many who previously lacked access to basic financial services.

The Future of Mobile Wallets: Emerging Trends

The future of mobile wallets is bright, with several exciting trends on the horizon. Biometric authentication, like fingerprint or facial recognition, is becoming increasingly common, offering a more secure and convenient payment experience. Integrating mobile wallets with other apps and services is also a significant trend.

The Challenges of Mobile Wallet Adoption

While mobile wallets offer numerous advantages, they also face challenges. Consumer trust in the security of these platforms is essential for widespread adoption. Education and awareness campaigns are crucial to address concerns and build confidence.

Furthermore, interoperability between different mobile wallet platforms is still a work in progress, which can create difficulties for users who need to use multiple platforms. Addressing these challenges is essential for the continued growth and success of mobile wallets.

Security Measures: Protecting Your Financial Data in the Digital Realm

Implementing Robust Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your mobile payment accounts. This method requires you to verify your identity using two different methods, such as a code sent to your phone via SMS and a password. By demanding both something you know (your password) and something you have (your phone), 2FA significantly reduces the risk of unauthorized access to your accounts, even if a hacker gains access to your password.

Activating 2FA for all your mobile payment accounts is a crucial step in safeguarding your financial data. It's a small effort that can yield a substantial increase in security, preventing potential fraud and financial loss.

Regularly Updating Your Mobile Devices and Applications

Keeping your mobile operating system and payment apps up-to-date is essential. Software updates often include crucial security patches that address vulnerabilities exploited by cybercriminals. These updates are designed to strengthen your defenses against evolving threats and protect your sensitive financial information. Regularly checking for and installing updates is a proactive measure that significantly minimizes risks.

Outdated software can leave your device and payment applications susceptible to various security threats, potentially exposing your financial data to malicious actors. Staying current with updates is a simple yet effective way to maintain robust security.

Strong and Unique Passwords for Each Account

Using strong, unique passwords for each of your mobile payment accounts is paramount. Avoid using easily guessable passwords, such as your birthday or common words. Instead, create complex passwords that incorporate a mix of uppercase and lowercase letters, numbers, and symbols. This practice significantly reduces the likelihood of unauthorized access.

Don't reuse passwords across multiple accounts. If one account is compromised, the attacker gains access to all accounts using the same password. By employing unique and strong passwords, you create a robust barrier against unauthorized access and protect your financial data.

Being Vigilant About Phishing Attempts

Be highly cautious of suspicious emails, text messages, or pop-up notifications that prompt you to enter your login credentials or other sensitive information. Phishing scams are designed to trick you into revealing personal details. Verify the legitimacy of any communication before responding, especially those requesting financial information.

Always scrutinize the sender's email address or phone number, and avoid clicking on links or attachments from unknown sources. Practicing caution is the first line of defense against phishing attempts and protects your financial data from theft.

Protecting Your Device from Physical Theft or Loss

Take precautions to protect your mobile device from theft or loss. Enable device-locking features that require a passcode or biometric authentication when your device is locked. Consider using a strong screen lock to prevent unauthorized access. If your device is lost or stolen, immediately report it to the mobile payment providers to prevent fraudulent activity.

Activating location services on your device can aid in recovery if lost. Additionally, consider using a device tracking app to keep tabs on your phone's location. These precautions mitigate the risk of theft and unauthorized access to your mobile payment accounts.

Using a Secure Wi-Fi Network

Avoid using public Wi-Fi networks for sensitive transactions. Public Wi-Fi networks are often unsecured, making your device and financial information vulnerable to eavesdropping. If you must use a public network, consider using a virtual private network (VPN) to encrypt your connection and protect your data. Always prioritize using a secure and trusted connection when performing financial transactions using your mobile device.

Enable Account Monitoring and Alerts

Activating account monitoring and alert features can help you stay informed about any suspicious activity on your mobile payment accounts. Receive notifications about login attempts, transaction history, and other relevant information. This proactive approach enables you to address any unauthorized activity promptly and safeguards your financial data.

Regularly checking your account activity provides an early warning system for potential fraudulent transactions. By enabling alerts and monitoring your accounts, you can minimize the risk of financial loss and maintain the security of your mobile payment data.

Beyond Convenience: Payment Options and Features

Mobile Payment Security: A Multi-Layered Approach

Mobile payment solutions, while offering unprecedented convenience, require robust security measures to protect users' financial data. A multi-layered approach is crucial, incorporating encryption protocols, two-factor authentication, and regular security updates to the mobile application. This layered defense system aims to thwart potential breaches and safeguard user funds in real-time transactions.

The security of mobile payment systems is a critical concern. Users must understand that while these systems aim to provide ease of use, they also need to be vigilant about protecting their accounts and personal information. A sophisticated blend of technology and user awareness is essential to maintain a secure mobile payment ecosystem.

Transaction Verification and Fraud Prevention

Mobile payment platforms employ various verification methods to authenticate transactions. These methods often include biometric authentication, such as fingerprint or facial recognition, and one-time passwords (OTPs) delivered via SMS or email. This multi-factor authentication process significantly reduces the risk of unauthorized access and fraudulent activities.

Advanced fraud detection algorithms analyze transaction patterns in real-time to identify potential anomalies. These algorithms flag suspicious activities, such as unusual transaction amounts or locations, and alert users or the payment platform, preventing potential financial losses.

Data Encryption and Protection

Data encryption is fundamental to secure mobile payments. Sensitive financial information, like credit card numbers and account details, is encrypted both during transmission and storage, safeguarding it from unauthorized access. This encryption process transforms data into an unreadable format, making it virtually impossible for hackers to decipher.

Robust encryption protocols, coupled with secure storage solutions on the payment platform's servers, contribute significantly to the overall security posture. This ensures that even if a breach occurs, the compromised data remains indecipherable, minimizing potential damage.

User Awareness and Best Practices

While advanced security measures are in place, user awareness plays a vital role in mitigating risks. Users should be cautious about suspicious links or messages, avoid using public Wi-Fi networks for sensitive transactions, and regularly update their mobile payment applications. These simple precautions can significantly reduce the vulnerability of their accounts.

Education and awareness campaigns are crucial to empower users to recognize and avoid potential threats. This includes understanding the importance of strong passwords, the nature of phishing attempts, and the need to report suspicious activity promptly.

Two-Factor Authentication and Security Protocols

Two-factor authentication (2FA) adds an extra layer of security to mobile payment accounts. Beyond a username and password, 2FA requires a second verification method, such as a one-time code sent via SMS or an authentication app. This significantly reduces the risk of unauthorized access, even if a password is compromised.

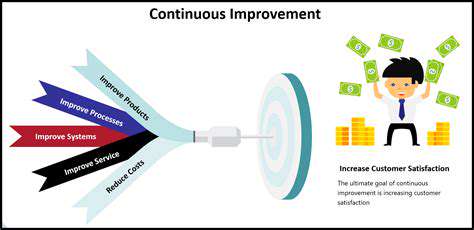

Security Audits and Continuous Improvement

Regular security audits are essential to identify vulnerabilities and ensure the ongoing effectiveness of security measures. These audits help in proactively addressing potential weaknesses before they can be exploited by malicious actors. Mobile payment platforms should regularly update their security protocols to address emerging threats.

Continuous improvement in security measures is paramount. The evolving landscape of cyber threats necessitates constant vigilance and adaptation to maintain a strong security posture. This involves staying ahead of the curve by incorporating the latest security technologies and best practices.

Payment Gateway Security and Compliance

The security of the payment gateway itself is crucial. Payment gateways must adhere to industry standards and regulations, such as PCI DSS, ensuring the secure handling of sensitive financial data. This includes robust encryption, secure infrastructure, and regular security audits to maintain compliance and trustworthiness.

Payment gateways need to implement security measures that are not only effective but also demonstrably compliant with regulatory standards. Transparency and accountability in these security practices build trust with users and stakeholders, ensuring the long-term viability of the payment system.

The Impact on Businesses and Consumers: A Symbiotic Relationship

The Shifting Landscape of Consumer Behavior

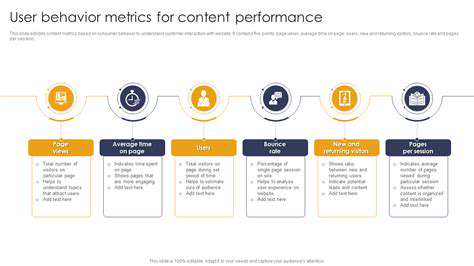

Consumer behavior is constantly evolving, driven by technological advancements, social trends, and economic shifts. Understanding these dynamics is crucial for businesses to adapt and thrive in today's market. Consumers are increasingly demanding personalized experiences and are more likely to research products and services online before making a purchase. This shift necessitates a more targeted and data-driven approach to marketing and product development.

Adapting to Evolving Technological Trends

The integration of technology into everyday life has dramatically altered consumer expectations. Businesses must embrace digital transformation to stay competitive. This includes implementing e-commerce platforms, leveraging social media marketing strategies, and utilizing data analytics to gain insights into customer preferences. Failure to adapt to these technological advancements can lead to a significant loss of market share.

The Rise of Sustainability and Ethical Consumption

Consumers are increasingly conscious of the environmental and social impact of their purchases. Sustainability and ethical sourcing are becoming key factors in purchasing decisions. Businesses that prioritize sustainability and ethical practices are more likely to attract and retain customers. This means companies need to clearly communicate their environmental and social responsibility initiatives to consumers.

The Importance of Personalized Customer Experiences

Personalization is no longer a luxury; it's a necessity for businesses to succeed. Understanding individual customer needs and preferences allows for tailored marketing campaigns, product recommendations, and customer service interactions. Providing a seamless and personalized experience can significantly boost customer loyalty and advocacy. A personalized approach fosters stronger customer relationships.

The Power of Data-Driven Decision Making

Collecting and analyzing customer data is essential for businesses to understand their target audience and make informed decisions. Market trends, purchasing patterns, and customer feedback can be used to optimize strategies, personalize offerings, and improve overall performance. Data analytics empowers businesses to gain valuable insights and proactively address emerging challenges. The ability to leverage data effectively is becoming a competitive differentiator.

Managing Customer Expectations and Building Trust

High customer expectations are the new normal. Businesses must strive to exceed these expectations to build and maintain trust. Excellent customer service, quick response times, and transparent communication are vital components of building a positive customer experience. Building trust and loyalty through consistent quality and exceptional customer service is paramount. This trust creates a sustainable and valuable customer base for businesses.

The Impact of Economic Fluctuations on Consumer Spending

Economic downturns and uncertainties can significantly impact consumer spending habits. Businesses need to be adaptable and responsive to these changes. By offering competitive pricing, highlighting value propositions, and providing flexible payment options, companies can retain customers during challenging economic times. Economic instability requires careful financial planning and strategic adjustments to business operations. Businesses must anticipate and adapt to economic fluctuations to ensure long-term success.