Securing Transactions: Robust Encryption

When you use mobile payments, your financial data gets wrapped in multiple layers of digital armor. Advanced encryption scrambles your payment details into unreadable code during transmission, creating a formidable barrier against potential interceptors. This security blanket extends to how your information gets stored - both on your device and payment processors' servers - dramatically reducing fraud risks.

The encryption landscape constantly evolves, with standards like AES (Advanced Encryption Standard) leading the charge against emerging cyber threats. This arms race between security experts and hackers ensures mobile payment protections stay several steps ahead, giving users peace of mind with every tap or scan.

Reliable Infrastructure: Network Stability and Server Capacity

Behind every successful mobile payment lies an invisible network of technological muscle. Stable connections form the backbone of instant transactions, while powerful servers work overtime to process millions of payments simultaneously without breaking stride. This infrastructure shines brightest during peak periods like holiday sales, when transaction volumes spike dramatically.

Engineers build redundancy into these systems like digital safety nets. When one pathway fails, backup systems instantly reroute transactions, ensuring your payment goes through even during unexpected outages. This behind-the-scenes engineering makes mobile payments remarkably resilient.

User Authentication: Multi-Factor Verification

Modern mobile payments demand more than just a password - they require proof you're really you. Multi-factor authentication combines something you know (like a PIN), something you have (your phone), and something you are (your fingerprint or face) to create a digital fortress around your transactions. Even if a hacker steals one element, they'll hit a wall without the others.

This layered security approach has slashed fraudulent transactions across the industry. Banks report up to 99.9% reduction in account takeovers when implementing proper MFA, transforming mobile payments into one of the most secure transaction methods available.

Compliance and Regulations: Meeting Standards

The mobile payment industry operates under watchful regulatory eyes. Organizations like PCI SSC set rigorous security benchmarks that all providers must meet, covering everything from data encryption to breach response protocols. These standards evolve alongside emerging threats, creating a constantly improving security framework.

Fraud Prevention: Real-time Monitoring

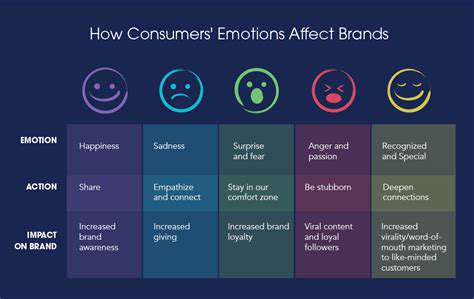

Sophisticated AI systems now monitor transactions with hawk-like precision. Machine learning algorithms analyze spending patterns across millions of users, instantly flagging anomalies like sudden large purchases or transactions in unusual locations. These systems improve daily, learning from each attempted fraud to better protect users tomorrow.

When suspicious activity appears, multiple safeguards spring into action - from temporary transaction freezes to instant verification requests. This multi-layered defense combines technology with human expertise, creating a security net that's both wide and finely woven.

Diverse Payment Methods for Every Need

Credit and Debit Cards: Digital Evolution

Plastic cards have successfully transitioned to the digital realm, maintaining their position as payment staples. Mobile wallets now store card details securely, letting users pay with their phones while still earning rewards and building credit history. Advanced features like instant transaction notifications and spending analytics give users unprecedented control over their finances.

Security innovations like dynamic CVV codes (which change periodically) and virtual card numbers add extra protection layers for online purchases. These enhancements address traditional card vulnerabilities while preserving all the familiar benefits.

Mobile Wallet Apps: Digital Swiss Army Knives

Today's mobile wallets do far more than store payment methods. They've become financial command centers, integrating loyalty programs, transit passes, event tickets, and even identification documents. This consolidation means users can leave their physical wallets at home with confidence, knowing everything they need lives securely in their smartphone.

The convenience extends beyond payments - many wallets now offer budgeting tools, subscription management, and personalized financial insights. This transformation from simple payment tool to comprehensive financial assistant explains why mobile wallet adoption continues accelerating globally.

Digital Wallets: The Cashless Revolution

Modern digital wallets break free from traditional banking constraints. Users can load funds directly into their wallet accounts, creating self-contained spending ecosystems perfect for travel, allowances, or budget management. These platforms increasingly serve as bridges between different financial services, enabling seamless money movement between banks, investments, and payments.

The user experience focuses on simplicity - sending money often requires just selecting a contact and entering an amount. This ease-of-use has made digital wallets particularly popular among younger generations who value speed and convenience above all.

Near Field Communication (NFC) Payments: The Tap Revolution

NFC technology has transformed payment terminals worldwide. What began as a novelty - tapping your phone to pay - has become the expected standard in many markets. The technology's speed and simplicity benefit both consumers and businesses, with transactions completing in seconds versus minutes for traditional card payments.

Adoption continues growing as merchants recognize reduced checkout times mean happier customers and higher throughput. Some retailers report being able to serve 20-30% more customers per hour after switching to primarily contactless payments.

Rewards Programs: Smarter Spending

Mobile payment rewards have evolved beyond simple cashback. Modern programs use AI to personalize offers based on spending habits, location, and even the weather. Some platforms automatically apply the best available discounts at checkout, while others let users choose between instant savings or long-term point accumulation.

The most innovative programs now integrate across multiple merchants, allowing rewards earned at one business to be redeemed at another. This ecosystem approach creates more value for consumers while driving cross-business engagement.

Government Digital Currency: The Future Arrives

Several nations now pilot central bank digital currencies (CBDCs) that could redefine mobile payments. These government-backed systems promise near-instant settlement, reduced transaction costs, and greater financial inclusion. Early implementations focus on cross-border payments and financial access for unbanked populations.

While questions remain about privacy implications, the potential efficiency gains make CBDCs likely to play a major role in future payment ecosystems. Some experts predict they may eventually complement rather than replace existing payment methods.

Peer-to-Peer Payments: The Cash Replacement

P2P payment apps have made I'll pay you back frictionless. Splitting dinner checks, collecting rent payments, or sending birthday money now happens instantly without awkward ATM visits. The best platforms integrate with social networks and messaging apps, making money movement as easy as sending a text.

Security features like payment verification and transaction limits help prevent errors and fraud, while some services now offer purchase protection for certain P2P transactions - blurring the line between formal payments and casual money transfers.

The Future of Mobile Payments: Integration and Innovation

The Contactless Tipping Point

Contactless payments have reached critical mass globally. In many urban centers, carrying cash has become the exception rather than the norm, with even street vendors and taxi drivers accepting mobile payments. This shift reflects both changing consumer preferences and merchant recognition of faster throughput and reduced cash handling costs.

The pandemic accelerated this transition, but the convenience factor ensures it's permanent. Consumers who've experienced tap-and-go payments rarely return to fumbling with cards or cash, especially in high-volume environments like transit systems or quick-service restaurants.

Security in the AI Era

Next-generation security combines biometrics with behavioral analytics. Systems now learn individual usage patterns - how you hold your phone, typical purchase locations and times - to create invisible security profiles. Suspicious transactions might trigger additional authentication, while routine purchases proceed seamlessly.

Quantum-resistant encryption now enters the roadmap as payment providers prepare for future computing threats. These forward-looking measures ensure mobile payments remain secure even as hacking capabilities advance.

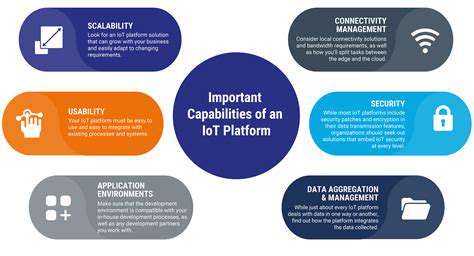

The Connected Commerce Ecosystem

Mobile payments increasingly serve as hubs connecting diverse services, from loyalty programs to digital identity verification. The most advanced platforms now integrate with smart devices, allowing payments directly from wearables, cars, or even appliances. Your refrigerator could soon order and pay for groceries when supplies run low.

Augmented reality adds new dimensions - point your phone at a product in a physical store to see personalized offers or payment options. Some retailers experiment with just walk out technology where mobile payment credentials automatically handle checkout as customers exit.

Mobile Payments: Benefits for Businesses and Consumers

Transforming Customer Experiences

Mobile payments remove friction from the purchasing process, turning what was often the least enjoyable part of shopping into an afterthought. The best implementations become invisible - your payment method automatically selects itself based on context, rewards optimize themselves, and receipts organize themselves digitally.

This seamlessness extends beyond retail - mobile payments now streamline everything from parking meters to charity donations, making spontaneous transactions effortless.

The Merchant Advantage

Businesses adopting mobile payments report multiple benefits beyond faster checkout. Digital transactions create rich data trails, helping merchants understand customer behavior at granular levels. This intelligence informs everything from inventory management to personalized marketing campaigns.

Operational efficiencies compound over time - one major retailer calculated $3 million annual savings just from eliminating receipt paper after going fully digital with payments.

Security That Scales

Modern mobile payment security operates at two levels - protecting individual transactions while safeguarding the entire system. Tokenization replaces sensitive data with unique identifiers, making breaches far less damaging. Distributed ledger technologies now enhance certain payment networks, creating transparent yet secure transaction records.

These systems prove their worth daily - mobile payment fraud rates consistently fall below traditional card-not-present fraud, despite handling growing transaction volumes.

Financial Inclusion Breakthroughs

In developing economies, mobile payments often serve as entry points to formal financial systems. Farmers receive payments directly to mobile wallets, small businesses access credit based on transaction histories, and families send remittances across borders at minimal cost.

This democratization of financial services may represent mobile payments' most significant impact, potentially lifting millions from poverty by connecting them to the global economy.

The Agile Payment Infrastructure

Modern payment systems demonstrate remarkable adaptability. When the pandemic hit, businesses with mobile payment infrastructure could pivot to curbside pickup and contactless delivery almost overnight. This flexibility becomes increasingly valuable as consumer expectations evolve rapidly.

The most forward-looking platforms now incorporate cryptocurrency options and support emerging payment types, ensuring businesses stay ready for whatever payment innovations emerge next.