Ensuring Secure Mobile Payment Processing

Protecting Sensitive Data During Transactions

Mobile payment processing necessitates the secure handling of sensitive financial data, including credit card numbers, CVV codes, and expiration dates. Robust encryption protocols are crucial to safeguarding this information from unauthorized access. This involves using industry-standard encryption algorithms like AES-256 and ensuring that communication channels between the mobile device, payment gateway, and merchant are encrypted using secure protocols like TLS/SSL. Implementing multi-factor authentication adds another layer of security, requiring users to verify their identity with more than just a password, potentially using biometric authentication or one-time codes.

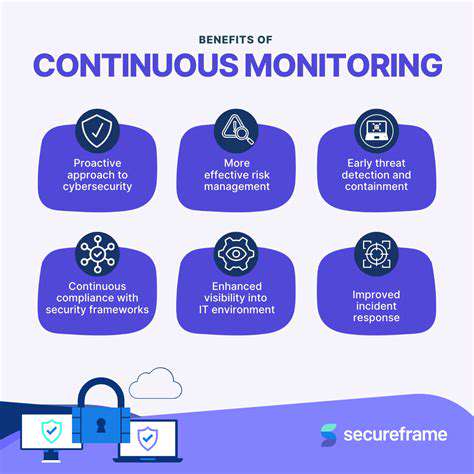

Data breaches can have devastating consequences, leading to financial losses and reputational damage for both individuals and businesses. Implementing comprehensive security measures, from encryption to multi-factor authentication, is essential to mitigate risks and protect user data. Continuous monitoring and security audits are also critical for identifying and addressing vulnerabilities in real-time and proactively preventing potential attacks. A well-rounded approach to mobile payment security requires a combination of technological safeguards and user education to foster a culture of security awareness.

Implementing Secure Payment Gateways and APIs

Choosing a reputable and secure payment gateway is paramount. This gateway should adhere to industry best practices for security and comply with relevant regulations, such as PCI DSS (Payment Card Industry Data Security Standard). Thorough due diligence is essential when selecting a payment gateway, as it plays a critical role in protecting sensitive transaction data. The gateway should provide robust security measures, including encryption and regular security audits, to ensure that data remains confidential and protected against unauthorized access.

Secure APIs are equally important for seamless and secure mobile payment processing. These APIs should employ strong authentication mechanisms to verify the identity of the requesting application and ensure that only authorized entities can access sensitive data. Implementing proper authorization controls is critical to limit access to specific functionalities and data based on user roles and permissions. Regular security assessments and penetration testing of the APIs are crucial to identify potential vulnerabilities and address them proactively.

Integrating secure payment gateways and APIs into the mobile application architecture is a critical step in ensuring robust security. Careful consideration should be given to the security implications of every integration point to prevent vulnerabilities and data breaches. Furthermore, mobile applications should be regularly updated to patch security vulnerabilities and adopt the latest security best practices.

By prioritizing secure payment gateways and APIs, businesses can significantly enhance the security of mobile payment transactions and build trust with their customers, fostering a secure and reliable payment experience.

Robust security measures are essential to protect users from fraud and financial loss. Regular security audits and penetration testing are necessary to identify vulnerabilities and ensure compliance with security standards.