Exploring the Rise of Altcoins

Beyond the dominant presence of Bitcoin, a burgeoning ecosystem of alternative cryptocurrencies, or altcoins, is rapidly expanding. These projects aim to address perceived limitations of Bitcoin, offering diverse functionalities and potential use cases. This burgeoning market presents both exciting opportunities and significant risks for investors.

Understanding the motivations behind the creation of these alternative coins is crucial. Many altcoins are designed with specific functionalities in mind, such as enhanced scalability, improved transaction speeds, or unique applications in specific industries. This variety makes the altcoin space incredibly complex and exciting to explore.

The Impact of Altcoins on the Crypto Market

The emergence of altcoins has significantly diversified the cryptocurrency market, making it a more robust and potentially lucrative arena. Their presence challenges Bitcoin's dominance and fosters competition, potentially leading to innovation and improved blockchain technology.

Altcoins often introduce new ideas and technologies into the crypto space, pushing the boundaries of what's possible. This constant evolution is a key factor driving the growth and development of the entire cryptocurrency sector.

Key Considerations for Altcoin Investment

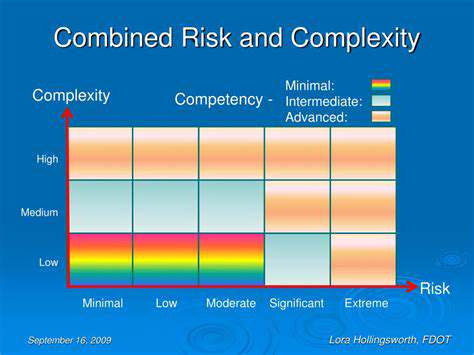

Investing in altcoins, while potentially rewarding, carries significant risks. Investors should conduct thorough research and understand the projects they're considering, evaluating their technical feasibility, team expertise, and overall market adoption.

Thorough due diligence is paramount. A strong understanding of the underlying technology, the team behind the project, and the project's potential market positioning is vital before committing any capital.

Different Altcoin Categories and Their Use Cases

Altcoins can be categorized based on their functionalities and objectives, such as privacy coins, stablecoins, and gaming coins. Each category serves a unique purpose, catering to different needs and use cases. For example, privacy coins prioritize user anonymity and data security, while stablecoins aim to reduce volatility and provide a more stable investment alternative.

Understanding the different categories and their specific use cases allows investors to make more informed decisions. This understanding can lead to more profitable opportunities in the cryptocurrency market.

The Role of Decentralized Finance (DeFi) in Altcoins

Decentralized finance (DeFi) is a significant driver in the altcoin space. DeFi applications, built on altcoin blockchains, offer a range of financial services, from lending and borrowing to decentralized exchanges, all operating outside traditional financial institutions.

Assessing Altcoin Market Trends and Volatility

Altcoin markets are notoriously volatile. Understanding market trends and staying informed about news and events impacting specific altcoins is critical for navigating this dynamic environment effectively.

The unpredictable nature of the altcoin market requires constant vigilance, and investors should be prepared to adapt their strategies as market conditions evolve. A well-defined risk tolerance is essential.

Regulatory Landscape and Future Outlook for Altcoins

The regulatory landscape surrounding altcoins is constantly evolving, and investors need to be aware of the legal frameworks in different jurisdictions. The future of altcoins is intertwined with the evolving regulatory environment and ongoing technological advancements.

The future of altcoins is uncertain but promising. Continued innovation and adoption could lead to widespread use cases and significant financial opportunities, while regulatory challenges could potentially hinder their growth.

Buy Now, Pay Later (BNPL): A Growing Force in E-commerce

Understanding the BNPL Model

Buy Now, Pay Later (BNPL) services offer consumers the ability to purchase goods or services immediately and pay for them in installments over a set period. This payment option has become increasingly popular, particularly among younger demographics, and has revolutionized the retail landscape, offering a flexible alternative to traditional credit cards. Understanding the core mechanics of BNPL is crucial to comprehending its impact on both consumers and businesses.

The core principle of BNPL is to bridge the gap between immediate purchase desires and the ability to pay in the short term. This allows consumers to access products and services they might otherwise be unable to afford upfront. This convenience often comes with fees and interest, which can have significant financial implications.

The Rise of BNPL in Retail

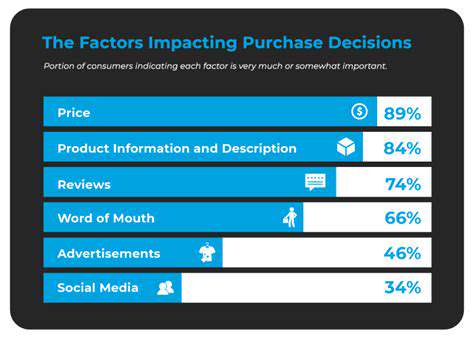

The BNPL sector has experienced rapid growth in recent years, driven by factors such as the rise of mobile commerce and the desire for greater financial flexibility. Retailers have embraced BNPL as a way to attract customers and boost sales, offering a tempting incentive for purchases that might otherwise be deferred. This has resulted in a significant shift in how consumers engage with online and physical retail environments.

Many retailers now integrate BNPL services directly into their online platforms and physical stores, streamlining the checkout process and offering a seamless shopping experience. This integration has significantly impacted the customer experience, leading to a more convenient and engaging shopping journey.

Consumer Benefits and Drawbacks

For consumers, BNPL offers the convenience of immediate gratification without the immediate financial burden of a large upfront payment. This can be particularly helpful for managing cash flow, especially during unexpected expenses or when budget constraints arise. However, consumers must be aware of the potential risks. Hidden fees and interest rates can quickly escalate the overall cost of a purchase.

Understanding the terms and conditions of each BNPL provider is vital before making a purchase. Carefully reviewing the interest rates, fees, and repayment schedules is paramount to avoiding financial pitfalls. Failing to do so can lead to unexpected debt accumulation.

Business Implications for Retailers

From a retailer's perspective, BNPL can be a powerful tool for attracting new customers and increasing sales volume. By offering flexible payment options, retailers can capture customers who might otherwise not make a purchase due to concerns about upfront costs. Increased sales volume can lead to higher revenue and profitability.

However, the complexity of managing BNPL transactions and the potential for increased operational costs must be carefully considered. Retailers need to weigh the benefits against potential challenges to ensure the integration of BNPL into their business model remains profitable and sustainable.

Regulatory Landscape and Future Trends

The regulatory environment surrounding BNPL services is constantly evolving, with various jurisdictions implementing new guidelines and regulations to protect consumers. This dynamic regulatory landscape requires businesses to stay informed about compliance requirements to avoid potential legal issues. Navigating the current and future regulatory environment will be critical for the long-term success of BNPL providers.

The future of BNPL is likely to be shaped by technological advancements and evolving consumer preferences. Expect continued innovation in areas like personalized financing options and integration with other financial services. The growth of BNPL will likely continue, but its evolution will be heavily influenced by these factors and the ongoing regulatory response.

The Integration of Traditional and Emerging Payment Methods

Traditional Payment Methods Remain Crucial

Despite the rapid rise of innovative payment technologies, traditional payment methods like credit cards, debit cards, and bank transfers continue to be indispensable in e-commerce. Their widespread acceptance, established infrastructure, and familiarity with consumers make them a cornerstone of online transactions. Many consumers still prefer these options due to their perceived security and the established trust they've built over the years. This reliance on established methods highlights the importance of ensuring seamless integration and a user-friendly experience for these transactions within the evolving online landscape.

Furthermore, the integration of traditional payment methods with emerging technologies is crucial. This involves ensuring compatibility and security protocols to allow for smooth transitions between different platforms and systems. The continued use of traditional methods necessitates a robust and secure infrastructure to handle the volume of transactions and protect sensitive customer data. A comprehensive strategy to integrate these methods with emerging payment platforms will be vital in maintaining a balanced approach to the future of e-commerce.

Emerging Payment Innovations Shaping the Future

The e-commerce landscape is constantly evolving, driven by the emergence of innovative payment methods. Mobile wallets, digital currencies, and buy-now-pay-later options are transforming how consumers make online purchases, offering greater convenience and flexibility. These new methods often streamline the checkout process, reduce transaction friction, and provide alternative financing options, ultimately attracting a wider range of customers to online platforms.

However, the adoption of these emerging payment methods also presents challenges. These include ensuring interoperability between different platforms, addressing security concerns related to new technologies, and educating consumers about the nuances of these new options. Successful integration of these emerging methods requires a delicate balance of innovation, security, and consumer education to ensure a smooth transition and widespread adoption.

The Symbiotic Relationship for Enhanced Customer Experience

The future of e-commerce lies in a symbiotic relationship between traditional and emerging payment methods. By leveraging the strengths of both, businesses can create a richer and more comprehensive payment experience for their customers. This includes providing a variety of options, catering to different preferences and needs, and constantly adapting to evolving consumer demands. The seamless integration of these methods will not only enhance the customer experience but also drive greater efficiency and profitability for e-commerce businesses.

A crucial aspect of this integration is providing a consistent and secure experience across all platforms, regardless of the chosen payment method. This encompasses user-friendly interfaces, robust security protocols, and clear communication regarding payment options and processing times. The ultimate goal is to create a frictionless and trustworthy payment experience that fosters customer loyalty and drives continued growth in the e-commerce sector.