Introduction to E-commerce Fraud

Understanding E-commerce Fraud

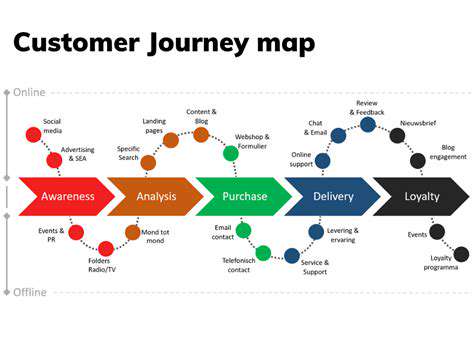

E-commerce fraud encompasses a wide array of malicious activities aimed at exploiting online marketplaces and businesses for financial gain. These fraudulent actions can range from simple attempts to obtain free goods or services to sophisticated schemes involving the creation of fake accounts, stolen identities, and the manipulation of payment systems. Understanding the different types of fraud is crucial for developing effective preventative measures. This knowledge allows businesses to anticipate potential threats and implement strategies to mitigate the risks associated with online transactions.

From simple account takeovers to complex credit card fraud, the tactics used by fraudsters are constantly evolving. This dynamic nature necessitates a proactive approach to fraud prevention, relying on advanced detection methods and robust security measures.

Types of E-commerce Fraud

E-commerce fraud manifests in numerous forms. Some common examples include payment card fraud, where fraudulent transactions are made using stolen or compromised credit card information; account takeover fraud, where malicious actors gain access to legitimate user accounts and make unauthorized purchases; and counterfeit product sales, where fraudulent sellers offer fake or inferior products, often at discounted prices.

Additionally, phishing scams, where fraudsters attempt to trick users into revealing sensitive information like usernames and passwords, are a prevalent concern in the online retail environment. Understanding the specific types of fraud prevalent in the market allows for tailored prevention strategies.

The Role of Machine Learning in Fraud Detection

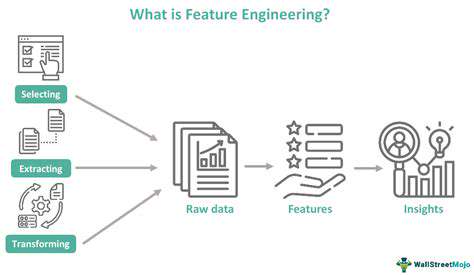

Machine learning (ML) algorithms have emerged as a powerful tool in combating e-commerce fraud. Their ability to analyze large datasets of transaction data, user behavior, and other relevant factors allows for the identification of patterns and anomalies that might indicate fraudulent activity. ML models can be trained to recognize subtle indicators of fraud that may be missed by traditional rule-based systems.

This proactive approach to fraud detection is crucial in minimizing financial losses and maintaining customer trust. ML algorithms can learn from past fraud incidents, adapting to new and emerging fraud tactics.

Machine Learning Models for Fraud Prevention

Various machine learning models are employed in e-commerce fraud detection, each with its strengths and weaknesses. Decision trees, support vector machines, and neural networks are frequently utilized. Decision trees offer a clear and interpretable approach to fraud classification, while support vector machines excel at identifying complex patterns in high-dimensional data. Neural networks, on the other hand, can capture intricate relationships within data, enabling them to adapt to sophisticated fraud schemes.

Implementing ML-Based Fraud Prevention Systems

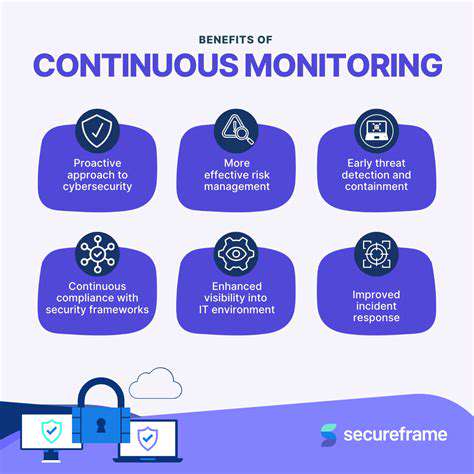

Implementing an effective machine learning-based fraud prevention system requires careful consideration of several factors. Data quality and quantity are paramount; accurate and comprehensive data are essential for training robust models. Furthermore, the system must be continuously monitored and updated to adapt to evolving fraud techniques. A crucial aspect of implementation involves integrating the system seamlessly into existing e-commerce platforms and workflows. The system should also be designed to minimize the impact on legitimate users while maximizing the detection of fraudulent activities.

Benefits and Challenges of ML in E-commerce Fraud

Implementing machine learning for e-commerce fraud prevention offers significant benefits, including reduced financial losses, enhanced customer trust, and improved operational efficiency. The ability to detect fraudulent activity in real-time allows businesses to take immediate action, minimizing potential damage. However, challenges exist in terms of model maintenance, data privacy concerns, and the need for continuous adaptation to emerging fraud tactics. Addressing these challenges is crucial for ensuring the long-term effectiveness of ML-based fraud prevention systems.