The evolution of contactless payment systems has undeniably transformed the way we interact with commerce. These systems have made transactions incredibly swift and seamless, eliminating the need for physical cards and the hassle of manually entering PINs. This convenience factor has resonated deeply with consumers, leading to a significant increase in adoption and driving innovation within the payment industry.

From simple tap-and-go transactions to more sophisticated mobile wallets, the options available to consumers are expanding rapidly. This ease of use has made contactless payments a popular choice for everyday purchases, from grabbing coffee to buying groceries.

Enhanced Security Measures: Protecting Your Financial Data

While the convenience of contactless payments is undeniable, security remains a paramount concern. Modern contactless payment systems incorporate robust security protocols to protect user data and prevent fraudulent activities. These protocols often leverage encryption and tokenization techniques to safeguard sensitive information. This proactive approach to security is crucial for building consumer trust and maintaining the integrity of the payment ecosystem.

Furthermore, advanced fraud detection systems are employed to identify and mitigate potential threats in real-time. These measures contribute significantly to the safety and reliability of contactless transactions.

The Rise of Mobile Wallets: Streamlining Digital Payments

Mobile wallets have emerged as a pivotal component of the contactless payment revolution. These applications allow users to store various payment cards and digital payment methods within their smartphones, making transactions quicker and more efficient. This integration of payment functionalities into everyday devices offers incredible convenience and accessibility to a wider range of users.

The seamless integration of mobile wallets with existing banking and financial platforms further enhances their appeal and user experience. The convenience of managing all payments from a single, central location is a significant advantage.

Integration with IoT Devices: Expanding the Reach of Contactless

The Internet of Things (IoT) is rapidly expanding the potential of contactless technology. Smart devices are increasingly integrating contactless payment capabilities, allowing for seamless transactions without the need for physical interaction. This integration extends beyond traditional payment terminals, opening up new possibilities for various sectors.

Imagine purchasing items in a smart home or making payments at a smart city kiosk without needing a physical card. The potential applications are broad and continue to evolve.

Biometric Authentication: Enhancing Security and Privacy

Biometric authentication methods, such as fingerprint scanning and facial recognition, are increasingly being incorporated into contactless payment systems. These methods offer a higher level of security compared to traditional PINs or passwords, making transactions more secure and reducing the risk of fraud. Implementing biometric authentication can significantly enhance the overall security posture of contactless payment solutions.

This added layer of security is particularly important in environments where physical security measures might be compromised.

Global Adoption and Standardization: Facilitating Cross-Border Transactions

The widespread adoption of contactless payment systems across the globe is driving the need for standardization. This standardization is crucial for facilitating seamless cross-border transactions. The ability to use the same contactless payment method in different countries without encountering compatibility issues is a significant advantage.

By establishing common protocols and guidelines, the global payment ecosystem can streamline operations and provide a consistent user experience.

The Future of Contactless Payments: Emerging Trends and Innovations

The future of contactless payment systems looks promising, with ongoing research and development exploring new and innovative features. Emerging trends include the integration of blockchain technology for enhanced security and transparency. This integration will likely lead to a more secure and trustworthy payment ecosystem, fostering greater consumer confidence and participation.

Furthermore, the development of more advanced payment methods, such as near-field communication (NFC) for high-value transactions, is shaping the future of contactless payments.

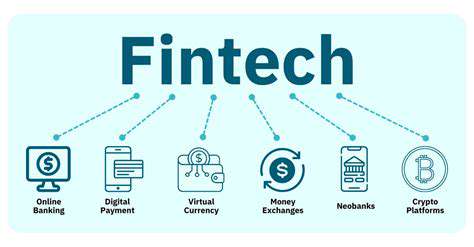

The Impact of Fintech and Alternative Payment Platforms

The Rise of Fintech Innovations

Fintech, encompassing a wide range of innovative financial technologies, is rapidly transforming the traditional financial landscape. From mobile payments and peer-to-peer lending to robo-advisors and blockchain-based solutions, these advancements are altering how people manage their finances and conduct transactions. This shift is driven by a desire for greater accessibility, efficiency, and cost-effectiveness in financial services.

The proliferation of fintech solutions has led to increased competition among financial institutions, forcing them to adapt or risk becoming obsolete. This competitive pressure is driving innovation and pushing the boundaries of what's possible in the financial world. The result is often a more user-friendly and accessible financial system for consumers.

Alternative Lending and Investment Platforms

Alternative lending platforms are providing access to credit for individuals and businesses who may not qualify for traditional loans. These platforms utilize alternative data points, such as credit scores and income verification, to assess creditworthiness, broadening access to financial services for a wider range of demographics. This is particularly helpful in bridging the gap for underserved populations who might be excluded from traditional financial markets.

These platforms are also offering investment opportunities that were previously unavailable to many retail investors. Crowdfunding platforms and peer-to-peer investment networks are expanding access to a broader range of investment choices, fostering a more inclusive financial ecosystem.

Impact on Traditional Financial Institutions

Fintech's disruptive nature is undeniably impacting traditional financial institutions. Banks and other established players are being challenged to keep pace with the rapid advancements in technology. They are being forced to embrace digital transformation strategies to maintain their competitiveness and relevance in the modern financial landscape.

Consumer Empowerment and Accessibility

Fintech is empowering consumers by providing them with greater control over their finances. Mobile banking apps, online payment systems, and personalized financial management tools are making it easier for individuals to track their spending, manage their budgets, and make informed financial decisions. This level of accessibility is particularly beneficial for those in underserved communities and regions with limited traditional financial infrastructure.

The Challenges of Regulation and Security

As fintech continues to evolve, challenges related to regulation and security become increasingly prominent. Ensuring the security of digital transactions, protecting sensitive financial data, and establishing clear regulatory frameworks to govern the rapidly evolving fintech landscape is vital. Maintaining consumer trust and confidence in these new technologies is paramount for their long-term success.

The Future of Finance

The future of finance is undoubtedly intertwined with fintech and alternative financial models. The convergence of technology and finance promises to create a more inclusive, efficient, and accessible financial system. However, navigating the challenges of security, compliance, and consumer protection will be crucial for ensuring the responsible and equitable development of this exciting new frontier in finance. The integration of these technologies into everyday financial activities will likely reshape how we interact with the financial system in the future.

Forecasting Future Trends in Mobile Payment Adoption

Factors Influencing Mobile Payment Adoption

Several key factors are driving the increasing adoption of mobile payment systems. Consumer convenience is paramount, as mobile wallets offer a streamlined and contactless experience, eliminating the need for physical cash or cards. This ease of use, coupled with the growing ubiquity of smartphones and reliable internet access, creates a powerful synergy for broader adoption. Furthermore, the security features implemented in modern mobile payment platforms, including encryption and multi-factor authentication, are reassuring users and bolstering trust in the technology.

The financial incentives offered by businesses and banks also play a significant role. Promotions, rewards programs, and attractive transaction fees can motivate consumers to switch to mobile payment methods. Additionally, the rising cost of physical cash handling, particularly for retailers, represents a compelling financial argument for integrating mobile payment solutions into their operations.

The Impact of Emerging Technologies

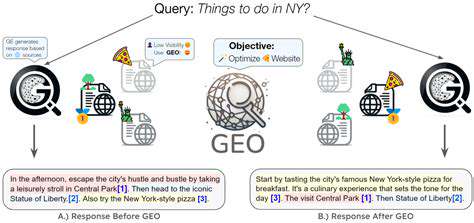

Artificial intelligence (AI) and machine learning are transforming the mobile payment landscape. AI-powered fraud detection systems can identify and prevent fraudulent transactions with greater accuracy and efficiency than traditional methods. This enhances the security and trust associated with mobile payments, encouraging wider adoption. Furthermore, the ability of AI to personalize user experiences, tailoring payment options to individual needs, is a key driver for future growth.

Blockchain technology, while still nascent in widespread mobile payment adoption, holds significant promise. Its potential for enhanced security, transparency, and efficiency in transaction processing could revolutionize the way mobile payments operate, potentially reducing transaction costs and increasing speed. However, its practical application and scalability still need further development and refinement.

Government Regulations and Policies

Government regulations and policies significantly influence the development and adoption of mobile payment systems. Clear and consistent regulations regarding data security, consumer protection, and financial transaction laws are crucial for building trust and encouraging wider participation. Stringent oversight of mobile payment service providers will be key to ensure that consumer data remains protected and that financial institutions operate within ethical and legal frameworks. International cooperation on these regulations will be critical for fostering global mobile payment adoption.

Consumer Preferences and Habits

Consumer preferences and habits are continuously evolving, and these shifts significantly impact the adoption of mobile payment systems. Younger generations are often early adopters of new technologies, and their preferences for digital transactions will likely shape the future of mobile payments. Understanding the motivations and concerns of consumers across various demographics will be crucial for businesses and financial institutions to tailor their offerings and effectively engage target markets.

Security and Fraud Prevention Measures

Security and fraud prevention remain critical concerns in the mobile payment ecosystem. Robust security measures are essential to protect consumer data and prevent fraudulent activities. Biometric authentication, two-factor authentication, and advanced encryption technologies are increasingly important components of secure mobile payment platforms. Continuous innovation in fraud detection and prevention methods will be necessary to keep pace with evolving threats and maintain user confidence.