The Rise of Omnichannel Payment Systems

The Evolution of Payment Methods

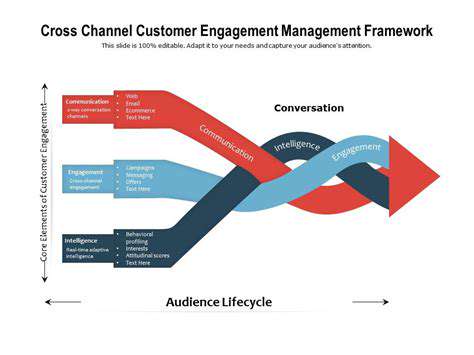

Omnichannel payment systems represent a significant shift in how businesses and consumers interact with financial transactions. Traditionally, payments were confined to specific channels like in-store credit card swipes or online bank transfers. This fragmentation often led to a less seamless and user-friendly experience. Now, with the rise of omnichannel solutions, consumers can initiate, manage, and complete transactions across various platforms, from mobile apps to physical retail stores, creating a more integrated and convenient financial ecosystem.

The increasing prevalence of mobile devices and the expansion of digital commerce have driven the need for unified payment experiences. Consumers expect a consistent and personalized experience regardless of the platform they use. This expectation has spurred innovation in payment technology, leading to the development of omnichannel platforms that can seamlessly switch between various payment methods and channels.

Enhanced Customer Experience and Convenience

Omnichannel payment systems offer a superior customer experience by providing flexibility and convenience. Customers can choose the payment method that best suits their needs and preferences, whether it's scanning a QR code in-store, making a mobile payment, or using a dedicated app for all transactions. This flexibility is crucial in today's fast-paced world where consumers are constantly looking for streamlined and efficient ways to manage their finances.

This seamless integration across channels fosters customer loyalty and satisfaction. Customers appreciate the ease of using a single platform for all their financial needs, which eliminates the hassle of switching between different payment systems and applications. The convenience and efficiency of omnichannel payments contribute significantly to a positive customer experience.

Furthermore, omnichannel systems facilitate personalized payment experiences. Businesses can leverage data from various touchpoints to tailor payment options and recommendations to individual customer preferences, leading to increased customer engagement and satisfaction.

Security and Fraud Prevention in Omnichannel Payments

While omnichannel payments offer numerous benefits, security remains a paramount concern. The increased complexity of these systems necessitates robust security measures to protect sensitive financial data from unauthorized access or fraudulent activities. Implementing strong encryption protocols, multi-factor authentication, and advanced fraud detection systems are critical to maintaining the trust and confidence of users.

Robust security measures are essential to mitigate risks associated with data breaches and fraud. Omnichannel platforms must incorporate advanced security features to ensure that transactions are protected from cyber threats. By prioritizing security, these platforms can build customer trust and confidence, enabling secure and reliable financial transactions across multiple channels.

Implementing sophisticated fraud detection algorithms is crucial to combat fraudulent activities effectively. These algorithms should analyze transaction patterns and identify suspicious activities in real-time, allowing for timely intervention and prevention of potential fraud. This proactive approach to fraud prevention is vital to preserving the integrity of omnichannel payment systems.

The Future of Omnichannel Payments

The Rise of Seamless Experiences

Omnichannel payments are rapidly evolving, moving beyond simple integration to encompass a truly seamless customer experience. This means that whether a customer is browsing online, interacting with a mobile app, or visiting a physical store, the payment process should feel intuitive and consistent. A key aspect of this evolution is the need for real-time data synchronization across all channels, allowing for personalized and proactive service.

Mobile-First Approach

Mobile devices are increasingly becoming the primary interface for many transactions. This shift necessitates the development of mobile-first payment solutions that are secure, user-friendly, and readily accessible on various platforms. From mobile wallets to QR code scanning, these solutions must adapt to the evolving needs and preferences of today's mobile-centric consumers.

Mobile payments offer significant advantages in terms of convenience and speed, but ensuring security and fraud prevention is paramount. Robust security measures are crucial to maintain consumer trust.

Enhanced Security Measures

As omnichannel payments become more prevalent, the need for enhanced security measures is paramount. Implementing robust encryption protocols, multi-factor authentication, and advanced fraud detection systems are essential to protect sensitive financial data. Consumers must feel confident that their transactions are secure and protected from unauthorized access. Data breaches and fraudulent activities can severely damage consumer trust and require significant recovery efforts.

Integration with AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are poised to play a transformative role in the future of omnichannel payments. AI-powered systems can analyze vast amounts of transaction data to identify patterns and predict potential risks, improving fraud detection and prevention. This technology can also personalize the payment experience by suggesting the most suitable payment methods based on individual customer preferences and transaction history.

Predictive analytics can provide invaluable insights into customer behavior, enabling businesses to offer more personalized and relevant payment options, leading to increased customer satisfaction.

Personalized Payment Experiences

The future of omnichannel payments emphasizes personalized experiences tailored to individual customer needs. This means offering a variety of payment options and adapting the payment process to the specific context of each transaction. For example, a customer might be offered a faster payment method for a time-sensitive purchase or a preferred payment option based on their past history.

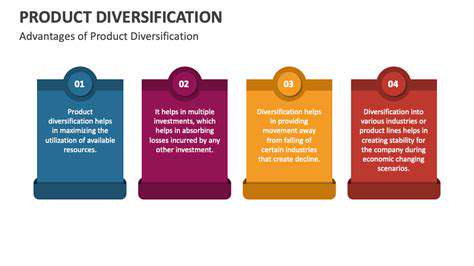

The Impact on Businesses and Consumers

Omnichannel payments will significantly impact both businesses and consumers. For businesses, it means improved customer satisfaction, increased sales, and streamlined operations. For consumers, it translates to greater convenience, faster transactions, and a more integrated and enjoyable shopping experience. The ability to seamlessly move between channels, without disruption, is a key driver of this change.

The evolution of omnichannel payments will continue to shape the financial landscape, driving innovation and benefiting both businesses and consumers.